The Ultimate Guide for First Time Home Buyers on Vancouver Island, B.C.

Article Summary

- Introduction

- Preparing for Your First Home Purchase

- Navigating First Time Home Buyer Programs

- Navigating The Vancouver Island Real Estate Market

- Frequently Asked First Time Home Buyer Questions

- Conclusion

Introduction

Welcome to the Ultimate Guide for First-Time Home Buyers on Vancouver Island, B.C. – brought to you by the Shanon Kelley Realty Group. If you’re ready to take the exciting step of buying your first home, this comprehensive guide will provide you with all the information you need to navigate the Vancouver Island real estate market and make a confident and informed decision.

Depending on your needs, there’s something for everyone:

- City life can be found in Nanaimo, Victoria, Comox Valley, Campbell River, and more – each with their own unique culture and areas to explore.

- Amazing West Coast Vancouver Island towns like Tofino, Ucluelet, and Sooke provide a world-class nature experience, each unique to their own style of nature with rugged landscapes, tidal pools, and surfing beaches.

- Cowichan Valley offers a perfect blend of rural charm and urban amenities, with its growing wine country and artisan communities.

- Northern Vancouver Island towns have a wealth of world-class nature to explore, ideal for those looking for a rural property on Vancouver Island, where you would have more land and space for projects, hobbies, and more.

Wherever you go on Vancouver Island, there will always be amazing nature to be explored and adventures to be had. This guide provides up-to-date information on market conditions, government programs, and practical advice to help you navigate your first home purchase in 2025.

Preparing for Your First Home Purchase on Vancouver Island

As of March 20, 2025, first-time home buyers on Vancouver Island need to be aware of several key financial considerations before entering the market. This guide covers the essential aspects of preparing for your first home purchase in this beautiful region of British Columbia.

Down Payment Requirements

The minimum down payment requirements in British Columbia remain:

- 5% of the purchase price for homes under $500,000

- 10% for the portion of the purchase price between $500,000 and $1,000,000

- 20% for homes over $1,000,000

For example, a $700,000 home would require a minimum down payment of $45,000 (5% of $500,000 plus 10% of $200,000). However, putting down less than 20% means you’ll need mortgage default insurance, which adds to your overall costs.

Property Transfer Tax Exemption

The First Time Home Buyers’ Program offers significant tax relief with recent updates:

- Full exemption on properties with a fair market value of $835,000 or less (increased from previous thresholds as of April 1, 2024)

- Partial exemptions for properties valued between $835,000 and $860,000

- The exemption applies to the first $500,000 of the purchase price

To qualify, you must:

- Be a Canadian citizen or permanent resident

- Have lived in B.C. for at least a year before registration or filed at least 2 B.C. income tax returns in the last 6 years

- Have never owned a principal residence anywhere in the world

- Use the property as your principal residence

- Ensure the property is 0.5 hectares (1.24 acres) or smaller

Your legal professional will handle the application when submitting the property transfer tax return. If you forget to apply during registration, you have 18 months to apply for a refund.

Additional Costs to Budget For

Beyond the purchase price, first-time buyers should budget for:

- Closing Costs (2-5% of purchase price):

- Legal fees ($1,000-$2,000)

- Property transfer tax (if not exempt)

- Home inspection ($400-$600)

- Appraisal fee ($300-$500)

- Title insurance ($200-$400)

- Moving Costs ($500-$5,000 depending on distance and volume)

- Immediate Home Expenses:

- Home insurance (required before closing)

- Utility setup fees

- Essential appliances or furniture

- Immediate repairs or renovations

- Ongoing Costs:

- Mortgage payments

- Property taxes

- Home insurance

- Utilities (water, electricity, gas, internet)

- Strata fees (if applicable)

- Regular maintenance (1-3% of home value annually)

Setting a Realistic Budget

When determining your budget, consider these key factors:

- Monthly Payment Comfort: Determine what monthly payment you can comfortably afford, considering all housing costs should ideally not exceed 32% of your gross household income.

- Down Payment Impact: A larger down payment reduces your monthly mortgage payments and potentially eliminates the need for mortgage insurance.

- Emergency Fund: Maintain a financial cushion for unexpected home repairs or income changes. Experts recommend having 3-6 months of expenses saved.

- Future Plans: Consider how long you plan to stay in the home and how your financial situation might change over that period.

Here at The Shanon Kelley Realty Group, we’re committed to guiding you through this important phase with top-notch customer-centric service. With our 16+ years of experience, we help guide home buyers through the budgeting process to help them find exactly what their budget is according to their real estate goals.

Remember, setting a budget isn’t just a number-crunching exercise; it’s about creating a financial plan that lets you enjoy your new Vancouver Island home without undue stress. Our friendly and experienced team is here to help you every step of the way.

Property Transfer Tax Exemption – First Time Home Buyers Program

When you purchase a Vancouver Island property, you’re typically required to pay a property transfer tax, which is:

- 1% on the first $200,000

- 2% on the remaining amount of your house cost, up to $2,000,000

- 3% on any amount above $2,000,000

However, as a first-time buyer, you might qualify for a full exemption if you’re planning to use the home as your primary residence and the purchase price is less than $500,000. Partial exemptions are also available for properties priced up to $525,000.

To be eligible for this exemption, you must, at the time the property is registered:

- Be a Canadian citizen or permanent resident

- Have lived in B.C. for 12 consecutive months immediately before registering the property or filed at least 2 income tax returns as a B.C. resident in the last 6 years

- Have never owned an interest in a principal residence anywhere in the world at any time

- Have never received a first time home buyers’ exemption or refund

More details on the Property Transfer Tax exemption for first time home buyers

Tax Credit for First Time Home Buyers

This non-refundable tax credit allows first-time buyers in Canada to recover some of the costs associated with their purchase. It helps offset legal fees, inspections, and other similar closing costs. The credit is worth $10,000, which translates to a maximum tax rebate of $1,500 as of 2023 (it was $750 until the 2022 budget was approved).

More details on the First Time Home Buyer’s Tax credit

RRSP Home Buyer’s Plan

The Home Buyers’ Plan (HBP) is a program that allows you to withdraw up to $35,000 tax-free in a calendar year from your registered retirement savings plans (RRSPs) to fund your down payment. The money must be in your RRSP for at least 90 days before the purchase of your house to be valid.

This plan is beneficial for Canadians because, generally speaking, early withdrawals from RRSPs are considered taxable income. In this case, they’re exempt, but you must start repaying the amount borrowed from the RRSP two years after buying your home, over a 15-year period.

More details on the RRSP Home Buyer’s Plan

First Time Home Buyer Incentive

The First-Time Home Buyer Incentive is a shared equity mortgage program offered by the Government of Canada. It’s designed to reduce monthly mortgage payments without increasing the amount needed for a down payment. Here’s how it works:

- The Government of Canada offers 5% or 10% of the home’s purchase price to put toward a down payment. This addition to your down payment lowers your mortgage carrying costs, making homeownership more affordable.

- The percentage you receive depends on the type of home you purchase. For a resale home, the government provides 5%. For a newly constructed home, you can get either 5% or 10%.

However, this is not a typical loan. This incentive is a shared equity mortgage. This means the government shares in the upside and downside of the property value. It’s a second mortgage on your home, but there are no regular principal payments. It doesn’t incur interest, but it needs to be repaid when you sell your home or at the end of 25 years, whichever comes first.

More details on the First Time Home Buyer Incentive

Newly Built Home Exemption (British Columbia)

The Newly Built Home Exemption reduces or eliminates the property transfer tax on qualifying purchases of a principal residence in British Columbia. This exemption is separate from the federal GST New Housing Rebate.

- Effective April 1, 2024, a full exemption is available for newly built homes with a fair market value of $1,100,000 or less (increased from the previous threshold of $750,000).

- A partial exemption is available for properties with fair market values between $1,100,000 and $1,150,000.

- The exemption is completely eliminated for properties valued at $1,150,000 and above.

To qualify for this exemption:

- You must be a Canadian citizen or permanent resident.

- The property must be located in B.C. and used as your principal residence.

- The property must be 0.5 hectares (1.24 acres) or smaller.

- The property transfer must be registered at the Land Title Office after February 16, 2016.

- This must be the first registration of the property with a completed improvement.

Occupancy requirements apply for the first year of ownership to maintain the exemption:

- You must move into your home within 92 days of the date the property was registered at the Land Title Office.

- You must continue to occupy the property as your principal residence for the remainder of the first year.

If you move out before the end of the first year, you may need to repay a portion of the exemption based on the number of days you didn’t occupy the property.

Note: If the owner passed away, or the property is transferred because of a separation agreement or a court order under the Family Law Act before the end of the first year, the full exemption still applies.

If you qualify for the exemption but didn’t apply when you registered your home, you may apply for a refund. Additionally, if you purchased a vacant lot and paid the tax upon registration, you may be eligible for a refund if you meet certain conditions.

More details on the Newly Built Home Exemption in British Columbia

In conclusion, while these programs can help make homeownership more affordable, it’s important to evaluate all your options and understand the implications of each program. It’s recommended to seek advice from a mortgage professional or financial advisor to discuss your specific needs and circumstances – contact us at The Shanon Kelley Realty Group if you want any recommendations!

Navigating The Vancouver Island Housing Market

Finding the Right Area & Home For You

When searching for your first home on Vancouver Island, it’s essential to find the right area that aligns with your lifestyle and preferences. Whether you’re looking for a vibrant urban neighbourhood or a serene beachside community, Vancouver Island has a variety of options to choose from. Working closely with a knowledgeable real estate agent will ensure you find a location that suits your needs and budget while considering the market value of the area.

A good method is to start by creating a list of your must-haves and deal-breakers, as well as a realistic budget. Attend open houses and view properties with a critical eye, taking note of any potential maintenance or renovation needs. Don’t be afraid to ask questions and seek guidance from The Shanon Kelley Realty Group throughout the process.

Vancouver Island Housing Market: A Deep Dive into 2025 Trends

Market Dynamics: Stability Amidst Change

As of April 2024, Vancouver Island’s housing market has found its footing after years of turbulence. But don’t mistake stability for stagnation – this market is alive with opportunity and challenge alike.

Key indicators paint a picture of resilience:

-

Board-wide sales increased by 26% in January 2025 compared to January 2024

-

Active listings rose by 5% board-wide in January 2025 year-over-year

-

Average prices increased by 3% across all property types from 2023 to 2024 ($707,663 to $728,908)

February 2025 showed continued stability with 493 unit sales board-wide, the same as one year ago, while active listings rose slightly to 3,235Benchmark Prices: The Numbers Behind the Narrative

The latest benchmark prices across Vancouver Island show modest year-over-year increases:

| Property Type | Benchmark Price | YoY Change | 5-Year Trend |

|---|---|---|---|

| Single-family homes | $773,200 | +2.3% | +15.7% |

| Apartments | $404,600 | +2% | +10.2% |

| Townhouses | $541,800 | +1% | +18.5% |

These figures tell a story of steady appreciation, outpacing inflation and rewarding long-term investors.

Regional Hotspots: Where the Action Is

Price Trends

-

Regional Highlights

Victoria

- Capital region maintains strong demand with single-family homes averaging $950,000

- Tech sector growth continues to fuel the market, particularly in Westshore areas

- Limited inventory keeping prices stable with modest growth

Nanaimo

- “The Harbor City” shows consistent demand with benchmark prices at $740,000 (up 4.2% year-over-year)

- Family homes remain in highest demand

- New developments expanding housing options

Duncan/Cowichan Valley

- Becoming increasingly popular for those seeking rural charm with urban amenities

- Single-family homes average $685,000 (up 3.8% from last year)

- Growing wine country and artisan community attracting new residents

Comox Valley

- Popular with retirees and outdoor enthusiasts

- Single-family homes around $650,000

- Premium pricing for oceanview properties

Campbell River

- Most affordable major center on the island with single-family homes at $620,000

- Attractive entry point for first-time buyers

- Steady appreciation making it appealing for long-term investment

Tofino/Ucluelet

- Vacation home market seeing renewed strength with prices up 6.5%

- Remote work flexibility driving “bleisure” (business + leisure) demand

- Limited inventory keeping prices elevated

Market DynamicsApartments: Average price of $405,000, up 1.8% from last year

- Overall sales volume up 8% year-over-year

- Average days on market decreased from 45 to 38

- Buyer confidence has risen significantly since late 2023

- New construction starts up 15%, but barely keeping pace with demandSingle-family homes: The benchmark price sits at $785,000, representing a 2.3% year-over-year increase

Market Forces: What’s Driving the Island’s Real Estate Scene?

- Interest Rates: Bank of Canada holds steady at 4.5%. This stability is boosting buyer confidence and helping to balance the market.

- Remote Work Revolution: 35% of recent buyers cite remote work flexibility as a key factor in their purchase decision. Home offices and high-speed internet are no longer luxuries – they’re necessities.

- Supply Crunch: New construction starts are up 15%, but they’re barely keeping pace with demand. Expect continued pressure on prices in desirable areas.

- Environmental Considerations: Rising sea levels and wildfire risks are influencing buyer behavior. Properties with resilient features command a 5-10% premium.

- Demographics: Millennials now make up 45% of first-time homebuyers on the island, reshaping neighborhood dynamics and driving demand for smart home technologies.

First-Time Buyer Programs (2025 Updates)

Property Transfer Tax Exemption

Updated April 1, 2024:

- Full exemption now available on properties with fair market value of $835,000 or less

- Partial exemption available for properties between $835,000 and $860,000

- The exemption applies to the first $500,000 of the purchase price

Eligibility requirements:

- Canadian citizen or permanent resident

- Lived in B.C. for at least one year before registration OR filed at least 2 B.C. income tax returns in the last 6 years

- Never owned a registered interest in a principal residence anywhere in the world

- Property must be 0.5 hectares (1.24 acres) or smaller

- Property must be your principal residence

Application process: Your legal professional will apply for the exemption when submitting the property transfer tax return.

First-Time Home Buyer’s Tax Credit

- Non-refundable tax credit worth $10,000

- Translates to a maximum tax rebate of $1,500 (as of 2023)

- Helps offset legal fees, inspections, and other closing costs

- Claimed on your income tax return for the year of purchase

RRSP Home Buyer’s Plan

- Withdraw up to $35,000 tax-free from your RRSP for a down payment

- Funds must be in your RRSP for at least 90 days before withdrawal

- Must begin repayment two years after purchase, over a 15-year period

- No tax penalty as long as repayment schedule is maintained

First-Time Home Buyer Incentive

Important Update: This federal program ended March 31, 2024.

Newly Built Home Exemption (British Columbia)

Updated April 1, 2024:

- Full exemption for newly built homes with fair market value of $1,100,000 or less

- Partial exemption for properties between $1,100,000 and $1,150,000

- No exemption for properties valued at $1,150,000 and above

Eligibility requirements:

- Canadian citizen or permanent resident

- Property located in B.C. and used as principal residence

- Property 0.5 hectares (1.24 acres) or smaller

- Property transfer registered after February 16, 2016

- Must be first registration with completed improvement

Occupancy requirements:

- Must move in within 92 days of registration

- Must occupy as principal residence for remainder of first year

Impact of New Regulations

Short-Term Rental Regulations

New provincial regulations implemented in 2024 are showing impact on the housing market:

- Principal residence requirement: Limits short-term rentals to your principal residence plus one secondary suite or accessory dwelling unit

- Provincial registry: Launching May 1, 2025, requiring all short-term rental hosts to register

- Registration display: All online listings must display registration numbers by May 1, 2025

- Market impact: Early data shows a 10% decrease in whole-home listings since implementation, potentially increasing long-term rental inventory and stabilizing housing prices

Mortgage Rate Environment

- Bank of Canada has implemented several interest rate cuts in 2024

- Overnight lending rate at 3.75% as of December 2024

- More favorable borrowing conditions for first-time buyers

- Pre-approval more crucial than ever to understand buying power

Looking Ahead: Market Trends for 2025-2026

Predicting real estate trends is never an exact science, but as we navigate through 2025, several clear patterns are emerging on Vancouver Island. Here’s what savvy investors and prospective homeowners should be watching:

Emerging Trends Shaping Vancouver Island Real Estate

- Climate Resilience Premium: Properties with enhanced climate resilience features are commanding 8-12% higher valuations. Buyers are increasingly scrutinizing flood zones, wildfire risk, and energy efficiency, creating distinct price tiers based on environmental risk assessment.

- “Missing Middle” Housing Boom: Municipal zoning reforms across Vancouver Island are finally addressing the “missing middle” housing gap. New developments of duplexes, triplexes, and townhomes in Victoria, Nanaimo, and Courtenay are creating fresh opportunities for first-time buyers priced out of single-family homes.

- Digital Nomad Communities: The evolution of remote work has transformed several Vancouver Island communities into thriving “Zoom towns.” Qualicum Beach, Ladysmith, and parts of the Cowichan Valley have seen particular growth as digital professionals seek affordable properties with high-speed internet and natural amenities.

- Luxury Market Reset: The $2M+ segment shows signs of price stabilization after years of dramatic growth. High-end buyers now have increased negotiating power, especially for waterfront and acreage properties, with average days-on-market extending to 72 days (up from 45 in 2023).

- Agri-Tourism & Culinary Investment: The Cowichan Valley continues its emergence as a culinary and wine destination, driving premium valuations for properties with agricultural potential. Land suitable for boutique farming, vineyards, or farm-to-table operations has appreciated 15% faster than comparable residential-only properties.

- Transportation Infrastructure Impact: The planned transportation improvements connecting Mid-Island communities are already influencing property values. Areas benefiting from enhanced connectivity are seeing advance price appreciation as buyers anticipate improved commute options.

Why Vancouver Island Continues to Thrive

The fundamental factors that drove Vancouver Island’s real estate renaissance during and after the pandemic have only strengthened in 2025:

- Lifestyle Priority Shift: The pandemic-induced desire for accessible natural spaces has evolved into a permanent lifestyle reprioritization. Vancouver Island’s unparalleled blend of outdoor recreation, moderate climate, and community connection continues to attract buyers from across Canada and beyond.

- Remote Work Permanence: What began as a temporary work arrangement has become standard practice for many employers. With 42% of Canadian knowledge workers now in permanent remote or hybrid positions, Vancouver Island’s appeal to location-flexible professionals continues to expand the buyer pool.

- Relative Affordability: Despite price appreciation, Vancouver Island still offers compelling value compared to Vancouver and other major Canadian cities. First-time buyers continue to find attainable entry points, particularly in emerging communities and multi-family developments.

- Retirement Destination: The island’s appeal to retirees has only strengthened, with healthcare infrastructure improvements and senior-focused community development creating new options for this demographic.

- Investment Stability: Vancouver Island real estate has demonstrated remarkable resilience through economic fluctuations, reinforcing its reputation as a stable long-term investment with both quality-of-life and financial returns.

Bottom Line: Vancouver Island’s real estate market in 2025 represents a sophisticated mosaic of opportunity. From Victoria’s cosmopolitan energy to the Cowichan Valley’s agricultural renaissance and the North Island’s untapped potential, each region offers unique value propositions. Whether you’re a first-time buyer, a seasoned investor, or simply exploring island possibilities, partnering with knowledgeable local experts like the Shanon Kelley Realty Group is essential for navigating this dynamic market landscape.

Note: This analysis reflects market conditions as of March 2025. Real estate trends can evolve rapidly. For the most current data and personalized advice, consult with our team at the Shanon Kelley Realty Group or check the latest Vancouver Island Real Estate Board statistics.

Frequently Asked Questions

Q: How long does the home buying process typically take on Vancouver Island? A: From beginning your search to completing the purchase, expect 2-4 months on average. This can vary based on market conditions and your specific requirements.

Q: Are there any special considerations for buying on Vancouver Island? A: Yes, consider water sources (municipal vs. well), septic systems vs. sewer, flood zones in coastal areas, and potential ferry access if not in Victoria.

Q: How competitive is the Vancouver Island market for first-time buyers? A: Competition varies by area and price point. Entry-level homes in Victoria and Nanaimo remain competitive. Working with an experienced agent and being pre-approved are essential advantages.

Q: What’s the minimum credit score needed to qualify for a mortgage? A: Most lenders require a minimum score of 640 for conventional mortgages, though some may approve scores as low as 600 with other compensating factors.

Q: Are there programs specifically for Indigenous first-time home buyers? A: Yes, the First Nations Market Housing Fund and specific Indigenous banking programs offer tailored mortgage products and support.

Conclusion

Vancouver Island’s real estate market in 2025 presents both opportunities and challenges for first-time home buyers. With updated government programs, changing regulations, and regional market variations, having current information and professional guidance is more important than ever.

The dream of homeownership on Vancouver Island remains achievable with proper planning, realistic expectations, and leveraging available programs. By taking advantage of first-time buyer incentives and working with experienced professionals, you can navigate this exciting journey successfully.

Feel free and welcome to explore our website or contact us directly with any questions you may have. We’re looking forward to the opportunity of working with you on this exciting journey.

Reviews for Our Realtor Services in Vancouver Island

Discover why Shanon Kelley Realty Group is trusted across Vancouver Island for exceptional real estate services! With glowing reviews from satisfied clients, such as the glowing Google reviews featured below, our team is known for guiding homeowners through every step of the buying and selling process. From Nanaimo's vibrant waterfront to Parksville's serene beaches, Qualicum Beach's charming community, and Nanoose Bay's tranquil landscapes, we’ve helped countless families find their dream homes. Whether it’s Duncan’s rich cultural heritage or Port Alberni’s outdoor paradise, we bring local expertise, personalized service, and a passion for helping you achieve your real estate goals. Our commitment to honesty, knowledge, and care shines through in every interaction—making us the go-to choice for real estate across Vancouver Island. Let us help you turn your vision into reality!

See what our clients are saying

Customer Centric Service For Vancouver Island Real Estate

Buyers & Sellers

Since 2007, The Shanon Kelley Realty Group has reliably provided customer centric service,

and we deliver curated goal orientated results.

Our Vancouver Island Address

4200 Island Highway North

Nanaimo, BC

V9T 1W6

Call Us!

Let’s Chat Real Estate.

+1 250-758-7653

Email Us at Our Email Address:

he***@**********ey.com

Articles & Guides to Vancouver Island

Service & Value for Vancouver Island Real Estate Buyers, Sellers and Explorers

Christmas on Vancouver Island 2025: Your Complete Holiday Guide

Support a Great Cause This Holiday Season Before you dive into all the festive fun, mark your calendar for a special event that gives back to our community: Burger & Beer Fundraiser In Support of The Nanaimo Hospital Palliative Care Ward When: November 21, 2025 |...

What’s Really Happening in Vancouver Island’s Real Estate Market Right Now

What's Really Happening in Vancouver Island's Real Estate Market Right Now The last few months have brought some significant shifts to Vancouver Island's real estate scene. At The Shanon Kelley Realty Group, we're seeing firsthand how these changes are affecting...

10 Ways to Make Friends and Help Your Neighbors in Ladysmith, Nanaimo & Parksville

Discover 10 rewarding volunteer opportunities in Ladysmith, Nanaimo & Parksville. From animal rescue to food banks, find ways to connect with your Vancouver Island community while making a difference. Perfect guide for new residents and locals looking to get involved.

Out-of-Town Buyer’s Guide: Your Complete Resource for Vancouver Island Real Estate

Complete guide for out-of-town buyers looking to relocate or invest on Vancouver Island. Includes travel options, accommodation tips, virtual tours, and market insights for mainland and international buyers.

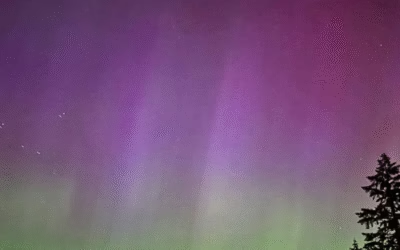

Your Backyard Could Be Vancouver Island’s Best Aurora Theater

Discover Vancouver Island homes with stunning aurora viewing potential. From Nanaimo to Campbell River, find waterfront properties perfect for northern lights watching. Expert real estate guidance from Shanon Kelley Realty Group.

Vancouver Island Real Estate Market Report 2025: What Buyers and Sellers Need to Know

Complete guide to Vancouver Island’s 2025 real estate market featuring new policies, mortgage rates, and ranked impacts on buyers and sellers. Includes BC Home Flipping Tax, Short-Term Rental Registry, and zoning changes.

How to Sell Your Home Fast in Nanaimo: The Ultimate Strategy Guide

How to Sell Your Home Fast in Nanaimo: The Ultimate Guide In Nanaimo's dynamic real estate market, selling your home quickly while maximizing your return requires strategy, preparation, and market knowledge. This comprehensive guide will walk you through proven...

Stress-Free Moving to Vancouver Island: A Realtor’s Insider Tips

Discover our comprehensive guide to moving on Vancouver Island with expert packing tips, timeline strategies, and island-specific advice for a stress-free relocation experience.

Secondary Suites on Vancouver Island: Benefits and Challenges | The Shanon Kelley Realty Group

The Changing Landscape of Secondary Suites in B.C. The recent cancellation of B.C.'s Secondary Suite Incentive Program (SSIP) marks a significant shift in the housing landscape for Vancouver Island homeowners. As of March 30, 2025, this program—which has provided...